Graphite mine receives feasibility study boost

Resources & Energy

A high-grade graphite mine due to be constructed in South Australia next year has received a boost after a feasibility study found it was commercially viable to develop.

Sign up to receive notifications about new stories in this category.

Thank you for subscribing to story notifications.

The study found Kookaburra Gully on South Australia’s Eyre Peninsula – for which an approved Mineral Lease is already in place – would be able to produce a range of high quality, globally sought-after graphite products, have room for further expansion beyond its initial 10-year mine life estimate, and be established at a capital cost of around AU$44 million.

The mine is 100 per cent owned by ASX-listed Lincoln Minerals Limited (ASX: LML).

The feasibility study looked into the value of converting the deposit into a modern-era, open-pit graphite mine. It used a processing rate of 250,000 tonnes per annum to produce approximately 35,000ktpa of flake graphite concentrate at a metals recovery rate of 90 per cent.

The project could expect to attract an average sales price of A$880-$1,350/t for standard mesh graphite products including polymer/plastic additives, lubricants, drilling fluids, friction materials and other industrial uses.

Longer-term opportunities include sales into the high-growth lithium-ion battery market – value-add factors not included in the feasibility study results announced today.

Metallurgical and pilot plant test work already undertaken by Lincoln confirm Kookaburra Gully’s ability to efficiently produce high grade graphite products up to purities of 98 per cent Total Graphitic Carbon (TGC).

Lincoln Managing Director Dr John Parker said today the company already had in place a marketing strategy to produce a range of flake graphite mesh products, from 7ktpa in Year 1 building to the 35ktpa target by Year 4.

“The outcomes of the Feasibility Study demonstrate a robust business case for the Kookaburra Gully Graphite Project and have substantially enhanced and de-risked the project’s development,” he said.

Mining will be undertaken via conventional truck and shovel open-pit mining methods, utilising the services of a mining contractor. It is expected the mine’s graphite concentrate will be packaged on-site into 25kg packets or 1-tonne bulka bags, loaded onto pallets or into 20-foot containers then transported via truck to Port Adelaide.

“There is no doubt that under the new findings and resource update, Kookaburra Gully is a world-class graphite deposit and is in an ideal position for a long-term operation to tap into the enormous growth forecast for graphite demand on the back of increased electrical vehicle and renewable energy battery sales and other high-tech uses,” Dr Parker said.

“Opportunities for further along-strike exploration and development at both Koppio and Kookaburra Extended have the potential to extend the mine life beyond 10 years.

“Completion of the Kookaburra Gully Feasibility Study, lodgement of the PEPR with the South Australian Government, and successful completion by KPMG of the proposed mine’s business case, are the key catalysts to facilitate a positive credit assessment of the project by potential financiers.”

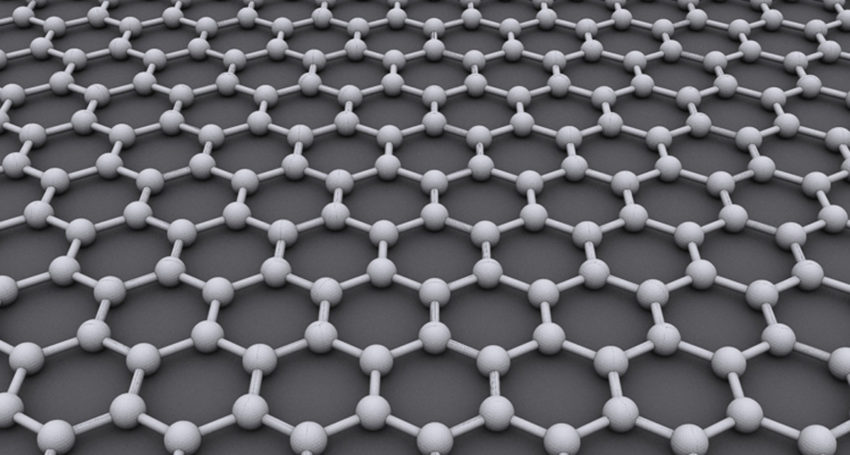

Graphite has seen a resurgence in price in recent times due to increased demand from applications such as lithium-ion battery technology for electric cars and the novel substance graphene.

It is also at the forefront of the growing global green energy market, with a proposed solar thermal power station 250km north of Lincoln’s Kookaburra Gully project estimated to require over 17,000 tonnes of graphite.

Lincoln has an agreement with Shanghai Jihai Investment Management Limited, a finance company based in Shanghai, China, to involve project financiers, graphene nano-materials application manufacturers, investment banks and institutions, in backing Kookaburra Gully’s establishment and future.

Dr Parker said China had dominated graphite production for several decades and produced about 70 per cent of the world’s supply.

“However, the graphite supply chain is changing, due in particular, to potential start-ups in eastern Africa and tighter environmental controls in China,” he said.

“In the long-term, as China’s economy shifts towards higher value-adding manufacturing and increased demand for minus-100 mesh flake graphite used in batteries, it is forecast that China may become a net importer of flake graphite.

“Over the next 24-36 months, it is anticipated that two or three natural flake graphite mines will commence operation in Africa, North America and elsewhere to replace the expected loss of natural flake graphite from China. However, these new mining operations will not be able to meet the anticipated growth in demand from the battery market as well as new technologies including graphene, fire retardants, geothermal and conductive products.”

Jump to next article