Australian miner lines up major Algerian zinc project

Mining & Resources

A South Australian mining company planning the largest base metal mine in Algeria is a step closer to construction following the completion of a revised Definitive Feasibility Study.

Sign up to receive notifications about new stories in this category.

Thank you for subscribing to story notifications.

Tala Hamza Zinc Project, near the Algerian city of Bejaia, is expected to produce an average of 129,300 tonnes per annum of zinc concentrate at 54 per cent zinc (90 per cent recovery) and 26,000 tonnes per annum of lead concentrate at 63 per cent lead (73 per cent recovery) over the 21 year mine life.

A processing plant with a 1.3 million tonne per annum capacity will also be built on site.

South Australian miner Terramin, through its subsidiary Western Mediterranean Zinc Spa (WMZ), hopes to have full approvals by the end of this year with the aim of processing the first ore in 2021.

“The Tala Hamza deposit is about 500 metres underground so we have to start mining the decline to reach the ore body and that’s what drives the construction timeframe,” Terramin Chief Executive Officer Richard Taylor said.

The Tala Hamza deposit is about 500 metres underground.

“This is a world-class deposit for zinc and lead, there aren’t too many of those undeveloped around the world that are known about.”

Terramin holds a 65 per cent shareholding in WMZ, with the remaining 35 per cent held by two Algerian government-owned companies.

Several changes have been made to the initial 2010 DFS to address social and environmental concerns and reduce the project’s surface footprint.

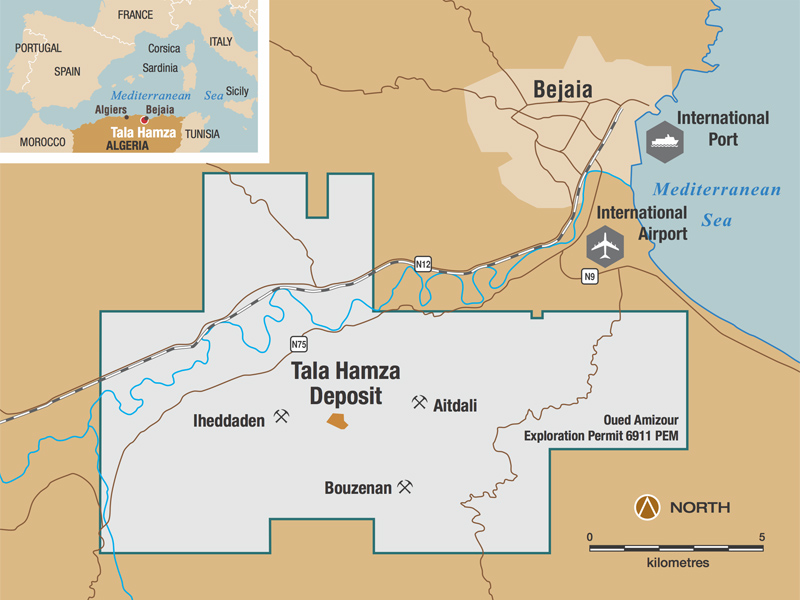

The 125sq km site is about 15km from the Mediterranean Sea port of Bejaia and 200km east of the Algerian capital Algiers.

Headquartered in Adelaide, South Australia, Terramin (ASX: TZN) has been listed on the Australian Stock Exchange since 2003. It has previous experience in zinc and lead mining in South Australia including at its Angas mine near Strathalbyn.

Taylor said the company was initially planning a large-scale block cave operation at Tala Hamza.

“That works from an economic perspective but it was the wrong approach at that point in time for Algeria, it’s a new mining jurisdiction and the area we are in is blessed with great infrastructure and proximity to the Mediterranean but it also means it is in close proximity to the city of Bejaia,” he said.

“It’s a very neat solution now, a much smaller project from the air but there will be a lot of work underground. It’s the right approach that balances the economic and the social factors.

“The current proposed design is very analogous with what we did at Angas but on a larger scale.”

The 125sq km site is about 15km from the Mediterranean Sea port of Bejaia and 200km east of the Algerian capital Algiers.

About 50 per cent of the world’s zinc supply is used for galvanising steel for use in various industries including construction and automotive.

Global demand for zinc is expected to continue to rise until at least 2030, particularly in developing nations where construction is strong.

Supply is expected to also ease from 2020 following a series of mine closures, which are expected to keep prices strong.

“Tala Hamza is one of the projects that need to go ahead to fill that demand gap,” Taylor said.

“There are also about five neighbouring targets for exploration that we haven’t even started looking at yet so we see the upside potential in that region as significant and this is just the first of what could be a series of developments in that area which is pretty exciting for us.

“Algeria has a lot of wealth from its oil and gas industry but like many countries that are reliant on oil and gas they are looking to diversify the economy and provide jobs.

“This will be one of the flagship projects for mining in Algeria, they do have a significant quarrying and bulk commodity industry there but this will be the largest base metals mine in the country.”

Total LoM capital inclusive of pre- production capital and sustaining capital is expected to be A$639m (US$486m) while operating costs are expected to be competitive by world standards.

Terramin has developed a good relationship with its Algerian joint venture partners and also has strong support from China.

“We have one very large Chinese SOE that’s a cornerstone investor and they have a lot of Algerian and North African experience with large scale construction projects,” Taylor said.

“Australia is recognised for its mining expertise so the partnership between China and Australia that comes forward in Terramin has given the Algerians a lot of confidence in how we will be able to develop the project.”

“We’re only 15km from a deep water port so it’s not far for us to be able to access Mediterranean markets but there is an existing small zinc smelter in Algeria and wherever possible we’ll be looking to support local industry.

“We’re also on the doorstep of Europe and we probably have one of the most competitive short hauls to reach their key smelters.”

Jump to next article